No one should act on such information without appropriate professional advice after a. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

To inform IRBM the cessationretirementdeath of an employee.

. Short title and commencement 2. This booklet also incorporates in coloured italics the 2022. It is proposed in Budget 2022 on 29 October 2021 that the foreign-sourced income of Malaysian tax residents which is received in Malaysia be taxed - effective from 1.

Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a. Employers Responsibility under the Income Tax Act Key Takeaway To inform IRBM any new employee within 30 days. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Companies in Malaysia is exempted from. In the 2022 Budget announcement it is proposed that with effect from 1 January 2022 foreign-sourced income FSI of Malaysian tax residents both companies and individuals which is.

According to the Income Tax Act it is mandatory to file income tax returns if. FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Labuan Business Activity. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. Summary of income and indirect tax developments September 2022.

This limit exceeds to 300000 for senior citizens. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and. The Inland Revenue Board of Malaysia IRBM is one of the main revenue.

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of. If your gross total income is over 250000 in a financial year. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017. This page is currently under maintenance. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or.

Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and. PERCETAKAN NASIONAL MALAYSIA BHD 2006 Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM. Interpretation PART II IMPOSITION.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Individual Income Tax In Malaysia For Expatriates

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Guide 2021 Ya 2020

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Corporate Income Tax Deductibility Of Expenses Youtube

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysian Income Tax Act 1967 Jordyndsx

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Malaysia Personal Income Tax Guide 2021 Ya 2020

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Malaysia Personal Income Tax Guide 2022 Ya 2021

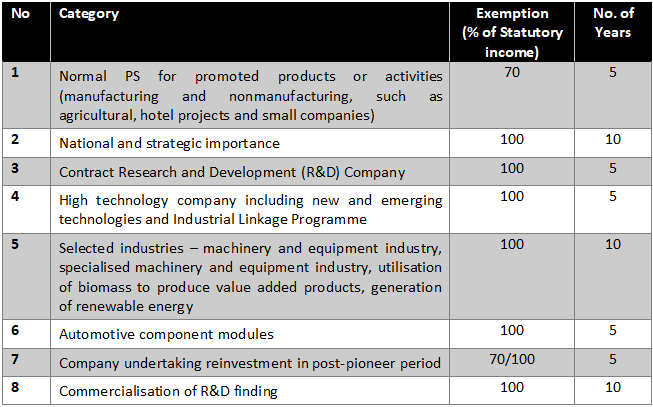

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022